Author: Stephanie

-

Completing the Correct 990 Return for Your Nonprofit Organization: Tax Filing Basics

Filing your organization’s tax return can be a once-a-year task that’s easy to overlook. To help you navigate the complexities of the 990 series returns, we’ve put together a guide outlining the filing requirements and the different forms available. Understanding the Basics The form you choose depends on your organization’s financial activity, which may vary…

-

Understanding IRS Error Codes: Filing an Extension Before the Tax Period Ends

If you receive the following E-file Error Code R0000-035-01: indicating you can not file an application for extension before the tax period ending date, what does that mean? How should you proceed? Keep reading to find out! Are you looking for more information on IRS 990 error codes? Check out our previous blogs in this…

-

Today is the December 990 Series Return Deadline for Certain Nonprofits!

‘This the season…to file your 990 series return! Today is the deadline for certain tax-exempt organizations to file their annual 990 series return with the IRS. This blog provides a guide to which organizations are required to meet this deadline and how to get started and complete their return by midnight! Which Organizations Must File…

-

Understanding IRS Error Codes: Fixing an Incorrect Exempt Status on 990 Returns

Welcome to the next installment of our ‘Understanding IRS Error Codes’ blog! If you receive any of the following E-file Error Code F990-913-01, F990-912-01, or F990-PF-906-01: this is an indication that the the tax-exempt status section in the return doesn’t match with the IRS E-file database, or the type of organization chosen in the Form…

-

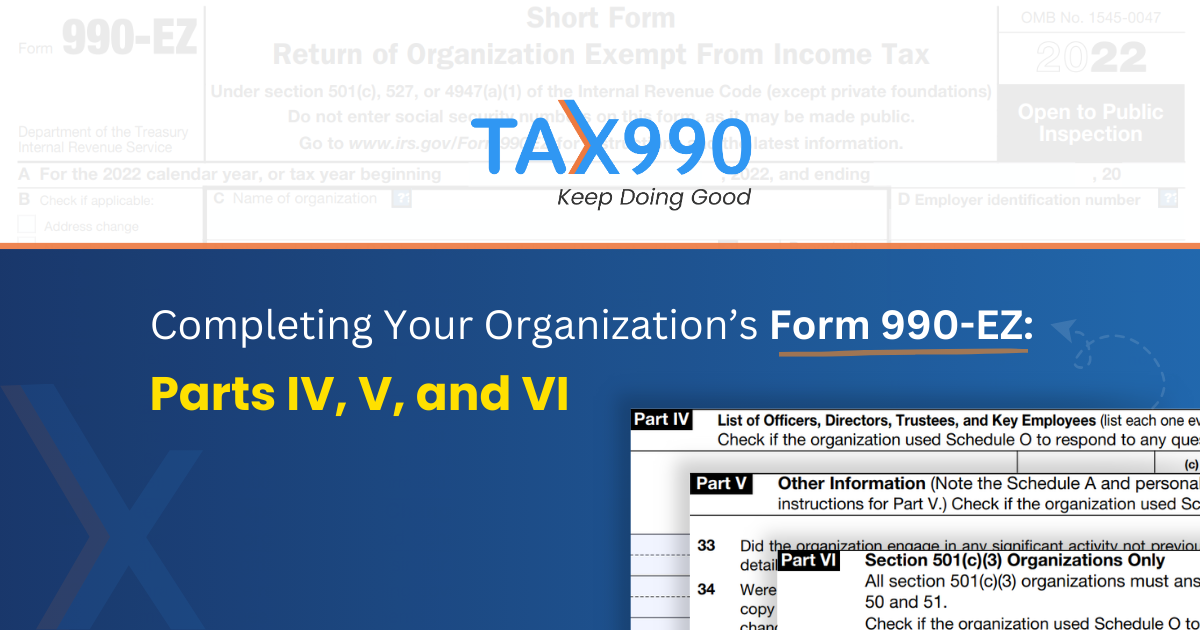

Completing Your Organization’s Form 990-EZ: Parts IV, V, and VI

In our last blog, we reviewed in more detail the process of completing Part I, II, and III of the 990-EZ form. In this blog, we will look at completing Parts IV, V, and VI of the 990-EZ return. In this section of Form 990-EZ, you will be providing detailed information regarding your organization’s officers,…

-

Form 990-EZ Filing Made Easy for Your Nonprofit: Parts I-III

Is the process of filing your organization’s annual Form 990-EZ return far from ‘easy’? Then this blog series is for you! In the next several blogs, we’ll be breaking down the form into manageable chunks and explaining the process and importance of completing these sections! Today we are kicking it off with the first three…

-

Reporting Program Accomplishments: A Hidden Opportunity for Storytelling

In the world of organizational management, where annual reporting is often viewed as a mere compliance necessity, lies an overlooked opportunity – the chance to tell your organization’s story through the lens of program accomplishments. Beyond the stringent requirements of the annual 990 series return, there’s a hidden potential to weave a narrative that not…

-

Understanding IRS Error Codes: Fixing an Incorrect Tax Year on 990 Returns

When it comes to completing your organization’s 990 Series Return, this is a process! Oftentimes this is a process that takes a village so to speak, so few things can be more disappointing than an IRS rejection. After the initial disappointment, there is of course the stress of “what’s next?” – here at Tax 990,…

-

IRS Classifications and Tax Filing Requirements for Private Foundations

Is your organization classified as a Private Foundation? It’s important to recognize the distinction between a public charity and a private foundation. Let’s delve into why your organization might fall under the category of a Private Foundation rather than a Public Charity. We’ll also explore how the IRS treats private foundations and examine the filing…

-

Nonprofits with a November 15th 990 Deadline Must File Today!

Many people are surprised to find that nonprofit organizations have strict filing requirements with the IRS, despite the fact that they are exempt from federal income taxes. All nonprofit organizations that are exempt under Section 501(c)(3) of the IRS tax code are required to file a 990 series return with the IRS on an annual…