Category: Uncategorized

-

The IRS E-file System is Now Open for 990-T, 1120-POL, and Extension Form 8868!

As you may know, the IRS temporarily shut down the e-file system for 990-T, 1120-POL, and extension Form 8868 in January for technical maintenance. On March 18, 2024, the IRS opened the e-file system, which means you can now start e-filing the tax returns mentioned. Read through this blog to get more information on…

-

Understanding IRS Error Codes: Fixing an Incorrect Exempt Status on 990 Returns

Welcome to the next installment of our ‘Understanding IRS Error Codes’ blog! If you receive any of the following E-file Error Code F990-913-01, F990-912-01, or F990-PF-906-01: this is an indication that the the tax-exempt status section in the return doesn’t match with the IRS E-file database, or the type of organization chosen in the Form…

-

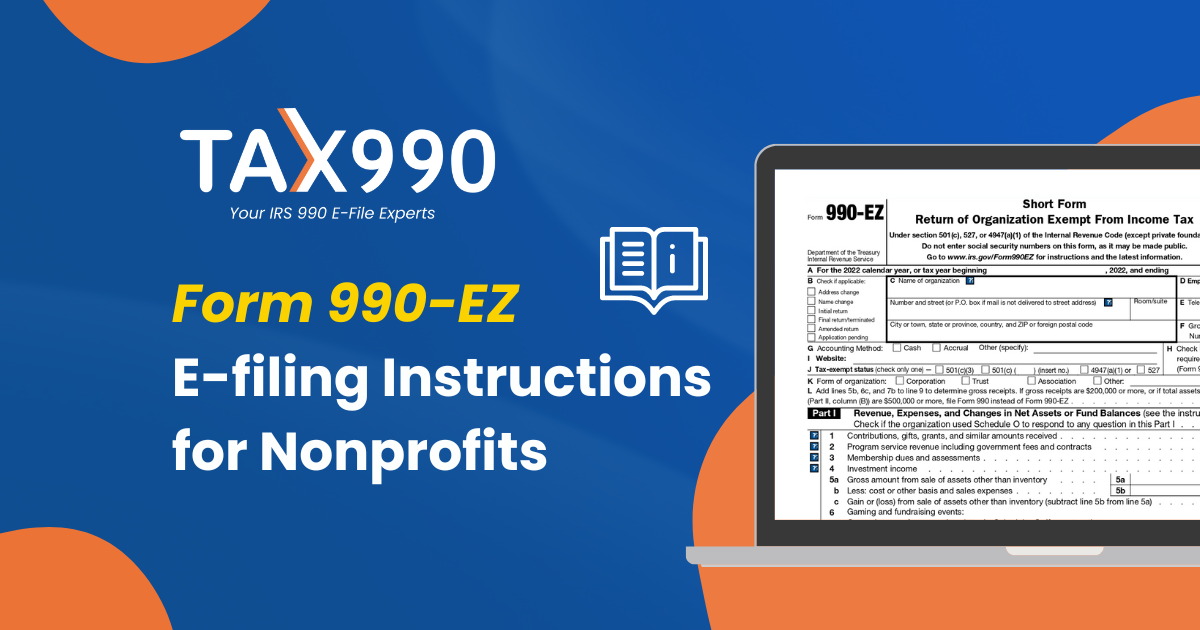

Form 990-EZ Filing Instructions for Nonprofits

Form 990-EZ is a return form used by tax-exempt organizations under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code whose gross receipts are less than $200,000 and greater than $50,000 during their tax year. It is a shortened version of the long Form 990 return. Depending on the type of organization and its…

-

What is the Difference Between a Public Charity and a Private Foundation?

Public charities and private foundations are both 501(c)(3) organizations, so what’s the difference?

-

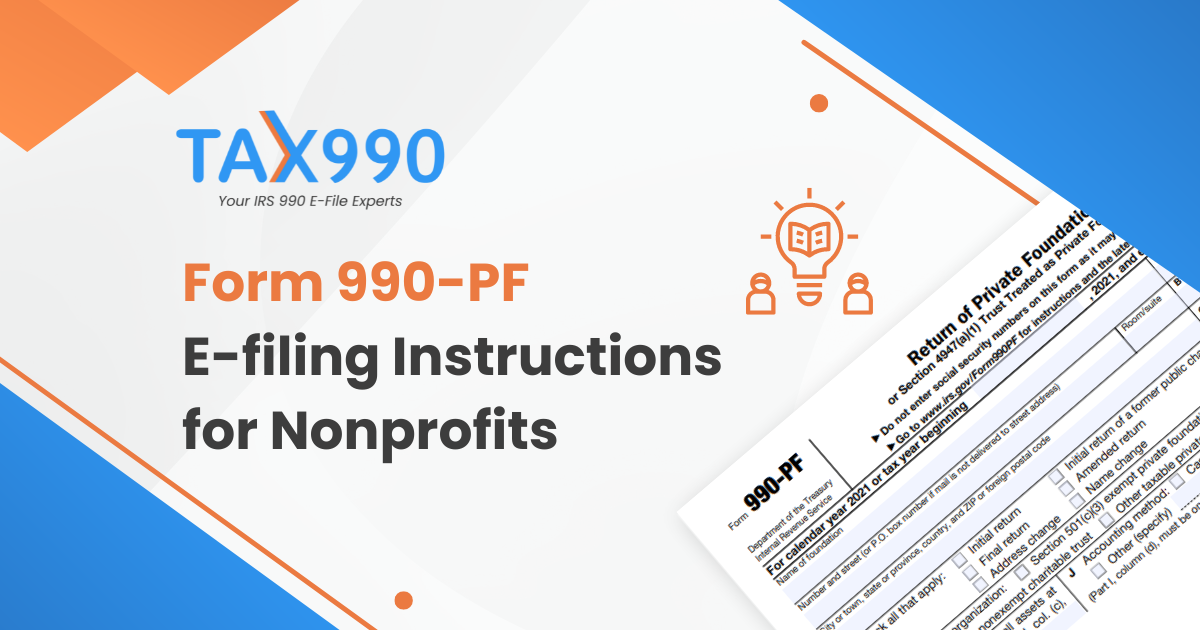

Form 990-PF E-Filing Instructions for Nonprofit Organizations

Read for step-by-step instructions on how to e-file Form 990-PF with Tax990!