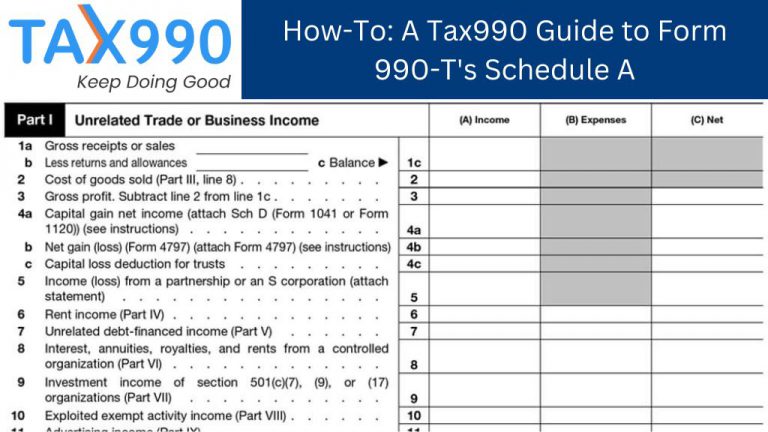

How-To: A Tax990 Guide to Form 990-T’s Schedule A

Form 990-T is filed by tax-exempt organizations to report their Unrelated Business Taxable Income (UBTI)–$1000 or more–to the IRS. Organizations that file Form 990-T should include Schedule A with their...