Let Tax990 Show You How to Complete Form 990-PF’s Balance Sheet!

First Things First – What is Form 990-PF and Who Needs to File it?

Form 990-PF is used by private foundations to report their revenue, expenses, direct charitable activities, capital gains, losses, officer details, distributable amount, qualifying distributions, and income-producing activities annually to the IRS. Additionally, it helps private foundations calculate taxes based on investment income.

Organizations must file Form 990-PF online before the 15th day of the 5th month after their accounting period ends.

In this article, we’ll go over one of the most important (and sometimes confusing) parts of Form 990-PF – the Balance Sheet (aka Part II of Form 990-PF).

Part II – Balance Sheet Sections and Components

Part II of Form 990-PF consists of three sections:

- Assets

- Liabilities

- Net Assets of Fund Balances

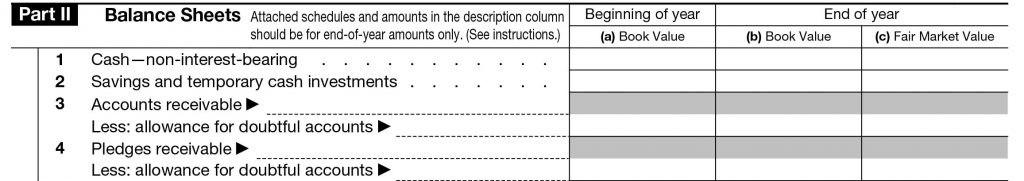

Assets

This section requires you to provide details regarding your foundation’s assets.

- Lines 1 – 15:

- Report details about cash, savings, and temporary cash investments; accounts receivable, pledges receivable, grants receivable, receivables due from officers, directors, trustees, and loans receivable; inventories for sale or use, mortgage loans, and other assets.

- Line 16:

- Enter the total assets value.

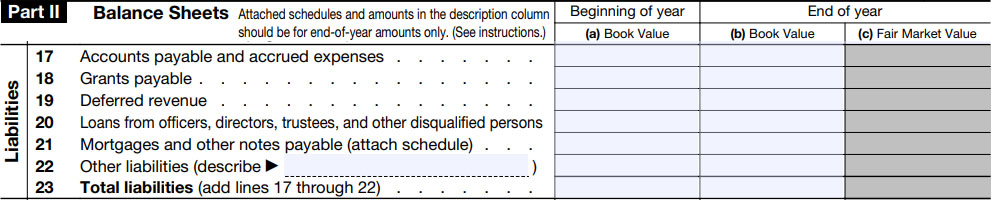

Liabilities

Here, you’re required to report details about various liabilities that your foundation has.

- Lines 17-22:

- Enter the value for accounts payable and accrued expenses; grants payable, deferred revenue, loans, mortgages, other notes payable, and other liabilities.

- Line 23:

- Add lines 17-22 and enter the value of Total Liabilities.

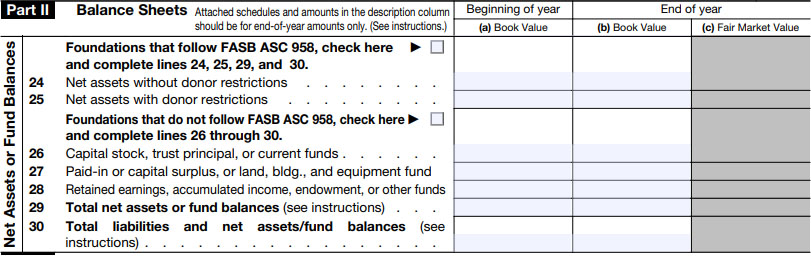

Net Assets of Fund Balances

Following the assets and liabilities, you can report your foundation’s net assets or fund balances in this section.

- Lines 24 and 28:

- Enter the values for net assets with AND without donor restrictions, capital stock, trust principal, current funds, retained earnings, accumulated income, endowment, and more.

- Line 29:

- Enter the value of total net assets or fund balances.

- Line 30:

- Enter the total liabilities and net assets/fund balances.

Let Tax990 Simplify Form 990 e-Filing for Your Private Foundation!

Tax990, the leading IRS-authorized e-file provider, removes all the hassle involved in preparing and filing your 990-PF. File easily and with confidence, thanks to features such as:

- SOC-2 Certification: Tax990 is a SOC-2 Certified Provider, ensuring the complete protection of your organization’s sensitive information.

- Free Schedules: All required 990 schedules (excluding Schedule K) are automatically included based on the data entered – for free!

- Bulk Upload Templates: Easily upload bulk contributions and grant details with custom Excel templates.

- Multi-User Access: Allow multiple staff members to assist with form preparation and filing.

- Live Customer Support: Our staff of experts is available to instantly resolve any issues via live chat, phone, and email.