Savvy Tips for Retaining and Accessing Your Nonprofit’s Vital Documents

Keeping meticulous records is not just a best practice; it’s an essential requirement for nonprofits. You never know when you…

Read More

Finishing Up Your Organization’s Form 990: Parts 10-12

When it comes to financial reporting for your organization, the balance sheet plays a pivotal role. It serves as the…

Read More

Certain Nonprofits are Required to File IRS Form 990 Returns by October 16th

Many people think that nonprofit organizations don’t have strict IRS reporting requirements because they are tax-exempt. This is a major…

Read More

A Deep Dive into Completing IRS Form 990: A Closer Look at Parts 7-9

The IRS Form 990 can be a complex and intimidating tax return. Whether you have recently taken on this responsibility…

Read More

Breaking Down Nonprofit Tax Form 990: Navigating Parts 4-6

Form 990: it’s a document that strikes fear into the hearts of many nonprofit organizations, but it doesn’t have to…

Read More

Understanding California Nonprofit Requirements – A Quick Guide

Creating and operating a nonprofit organization is a challenging feat. So much work goes into establishing and maintaining the organization’s…

Read More

Filing a 990: How it Can Benefit Your Church (and Your Church’s Donation Box)

Each and every year, thousands of nonprofit organizations file a Form 990–and while IRS regulations mean that all churches (that…

Read More

Form 990 Filing for Schools and Educational Organizations: Important Information and Deadlines

Do Schools and Educational Organizations Need to File a 990? Yes! Even after obtaining tax-exempt status, your School/Educational Organization still…

Read More

Form 990 (Part I-3): A 5-Minute Crash Course for Nonprofits

As a nonprofit organization, you are 100% dedicated to your mission and bettering your community. As the leader of the…

Read More

Form 990 Filling For Animal Rescue Organizations: A Tax990 Guide

While Animal Rescue Organizations are tax-exempt, there’s still certain information regarding their financial activities that must be reported to the…

Read More

What is Form 990’s Schedule B? How Do I File? A Tax990 Guide!

Organizations filing Form 990, 990-EZ, or 990-PF may also be required to attach Form 990 Schedule B to their forms,…

Read More

The September 15th Deadline is Here – Who Needs to File by Tomorrow?

Attention all tax-exempt nonprofit organizations with fiscal years ending April 30th – your Form 990 deadline is tomorrow, September 15th!…

Read More

501(c)(3) Organizations & 990 Filing: A Guide to Exemption/Filing Requirements

An organization having tax-exempt status means that the net profits of the organization are exempt from federal taxes. While certain…

Read More

So You Got an Error Code: Why and What to Do! A Tax990 Guide

Getting an error is–let’s face it–annoying. This is especially true when the codes are long strings of numbers that don’t…

Read More

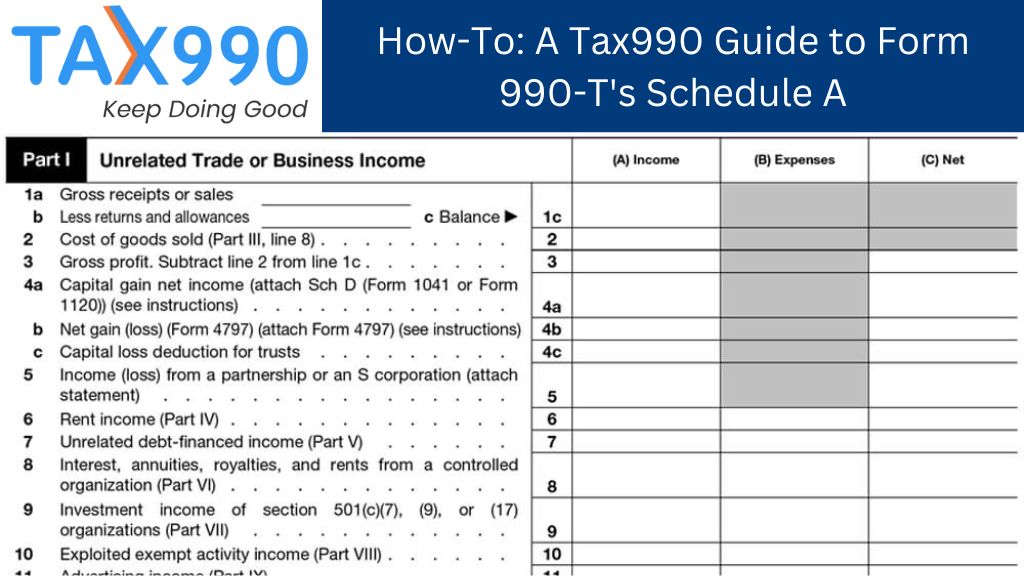

How-To: A Tax990 Guide to Form 990-T’s Schedule A

Form 990-T is filed by tax-exempt organizations to report their Unrelated Business Taxable Income (UBTI)–$1000 or more–to the IRS. Organizations…

Read More

Form 990: What You Need to Know About Filing for Your Nonprofit

**Editor’s Note**: This article originally appeared on Blackbaud’s “Engage” blog at https://blog.blackbaud.com/form-990-what-you-need-to-know-about-filing-for-your-nonprofit/. It is being republished with permission. It may…

Read More

I Received Error Code F990PF-905-01. What Should I Do? A Tax990 Guide!

Error Code F990PF-905-01 indicates the organization has not been established as a private foundation with the IRS (only private foundations…

Read More

The IRS Sent Me a Letter. Now What? A Tax990 Guide!

Receiving a letter from the IRS is not likely anyone’s idea of a nice surprise. Like taking medicine, though, it’s…

Read More

Maintaining Public Integrity for Nonprofit Organizations: It’s All About Trust

There are few things more valuable than trust. While it isn’t something you can hold in your hands, a lack…

Read More